Are you planning to opt for another commercial vehicle? In most cases, businesses often look for finance companies in Singapore for loaning and funding solutions. Whether you’re looking for a van or a heavy truck for your fleet enterprise, there are so many things to strain to get a vehicle for your business.

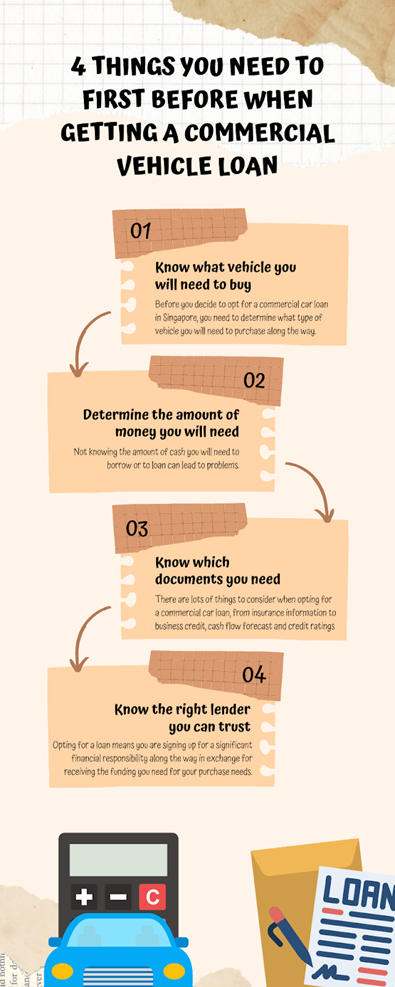

If you’re planning to opt for a commercial vehicle loan in Singapore, it seems complicated at first to get funding for purchasing a commercial vehicle. Apart from preparing documents, income proof and others, here’s what you should know first when getting a commercial vehicle:

Know what vehicle you will need to buy

Before you decide to opt for a commercial car loan in Singapore, you need to determine what type of vehicle you will need to purchase along the way. One way to narrow down your option is to compare the price and different specifications of a van or truck online. You can research what type of vehicle you will need along the way if you have no idea what to pick.

Determine the amount of money you will need

Not knowing the amount of cash you will need to borrow or to loan can lead to problems. You don’t want to end up obligating yourself by paying for an enormous amount of monthly pay and downpayment. Hence, preparing what cash you need early is a must!

Know which documents you need

There are lots of things to consider when opting for a commercial car loan, from insurance information to business credit, cash flow forecast and credit ratings. Each lender and loan will require different documents and revenue proof that you need to know.

Know the right lender you can trust

Opting for a loan means you are signing up for a significant financial responsibility along the way in exchange for receiving the funding you need for your purchase needs. While finding a lender isn’t difficult in today’s time, a licensed lender can give you more flexibility with quicker transactions and fewer credit checks!

If you are looking for a financing solution or planning to renew a COE loan with a calculator tool, visit Swee Seng Credit for other loan options!